I've never eaten or ate a poor person

but I know I hate them anyway!

I hate them on a rotisserie,

turned until their blood and juice are dripping with Justice

from our Judicial system

I hate to see them in line counting dimes

to buy some gas and make it to work on time

I hate not to have five bucks to throw their way

with nothing to say

I've never eaten or ate a poor person

But I sure know what it taste like.

Eaten or ate, Alive or dead, Whatever proper English is

I'm just a poor person and I hate it.

Bob Jenkens

Welcome to the United States

I'm just a dumb roofer and I write dumb poems. Even still I see something wrong with this.

We can't get an honest minimum wage requirement. Were taxed on our income and every thing we purchase. It seams to me this hurts more people than it could help. they can't make a healthcare

plan. but this will pass before they break for the holidays. Another scandal at capitol hill. Their raping the working....slight-of-hand-or-muslim-band.html

I wrote "Welcome to the United States" on my way to work. I was working for L.H Smith construction in Tecumseh Michigan. I pulled safely to the side of the road and wrote it on a McDonald's bag. When I got to the job Larry asked me why I was late? He acted like he was gonna hit me with his hammer when I told him "I stopped to write a poem".

And why a 10 year plan?

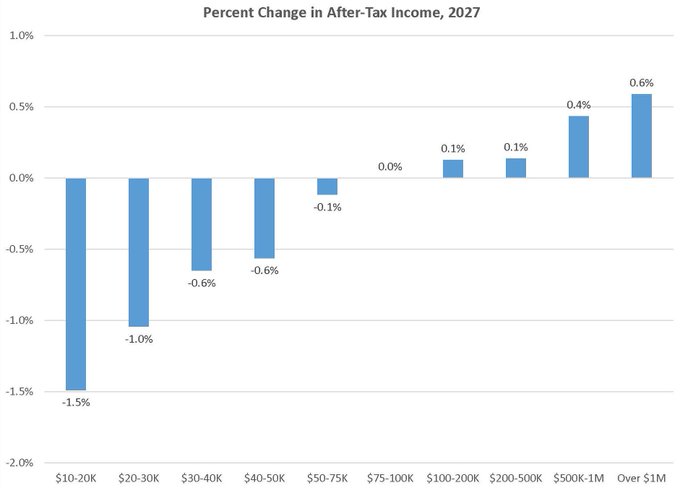

Senate Republicans’ tax plan raises taxes on families earning less than $75,000

It’s a workers’ party now.

/the-last-supper-bye-bob-jenkens.html

https://www.vox.com/2017/11/16/16665958/jct-analysis-senate-gop-tax-plan

/cdn.vox-cdn.com/uploads/chorus_image/image/57632225/874203392.jpg.1510851655.jpg)

No comments:

Post a Comment